TRADE FUTURES YOUR WAY

WE LIVE

FOR TRADERS

Futures, options on futures, microfutures, and more – all in one trading platform

THE BROKER CENTERED AROUND TRADERS

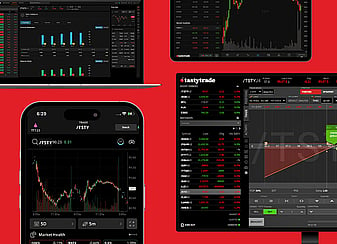

Smarter Tools For Smarter Futures Trading

ADVANCED CHARTING

Dig into the data with 300+ indicators.

FUTURES IN YOUR IRA

Futures, options on futures, and microfutures – all in your IRA.

Mobile, desktop, or web. The market stays at your fingertips.

MULTIPLE PLATFORMS

No wonder why serious traders choose us.

Dozens Of Futures Products. In One Place.

CME Group (Chicago Mercantile Exchange)

- E-mini S&P 500 (/ES)

- Micro E-mini S&P 500 (/MES)

- E-mini Nasdaq 100 (/NQ)

- Micro E-mini NASDAQ 100 (/MNQ)

- E-mini Dow 30 (/YM)

- Micro E-mini DOW (/MYM)

- E-mini Russell 2000 (/RTY)

- Micro E-mini Russell 2000 (/M2K)

- 2 Year T-Note (/ZT)

- 5 Year T-Note (/ZF)

- 10 Year T-Note (/ZN)

- 30 Year T-Bond (/ZB)

- Three-Month SOFR (/SR3)

- Micro 2-Year Yield (/2YY)

- Micro 5-Year Yield (/5YY)

- Micro 10-Year Yield (/10Y)

- Micro 30-Year Yield (/30Y)

- Ultra 10-Year U.S. T-Note (/TN)

- Ultra U.S. Treasury Bonds (/UB)

- Euro FX (/6E)

- Micro Euro (/M6E)

- Japanese Yen (/6J)

- British Pound (/6B)

- Micro British Pound (/M6B)

- Canadian Dollar (/6C)

- Micro Canadian Dollar (/MCD)

- Australian Dollar (/6A)

- Micro Australian Dollar (/M6A)

- Lean Hog (/HE)

- Live Cattle (/LE)

- Crude Oil (/CL)

- Micro Crude Oil (/MCL)

- E-mini Crude Oil (/QM)

- Henry Hub Natural Gas (/NG)

- E-mini Natural Gas (/QG)

- Gold (/GC)

- Micro Gold (/MGC)

- Copper (/HG)

- Silver (/SI)

- Micro Silver (/SIL)

- Corn Futures (/ZC)

- Mini Corn (/XC)

- Soybean (/ZS)

- Mini Soybean (/XK)

- Chicago SRW Wheat (/ZW)

- Mini Chicago SRW Wheat (/XW)

- Bitcoin (/BTC)

- Micro Bitcoin (/MBT)

- Ether (/ETH)

- Micro Ether (/MET)

Chicago Board Options Exchange

- CBOE Volatility Index (VIX) Futures (/VX)

- CBOE Mini Volatility Index (VIX) Futures (/VXM)

Prices Made With Traders In Mind

Products and PricesMade With Traders in Mind

**

*Applicable exchange, clearing, and regulatory fees still apply to all opening and closing trades.

**Exchange, clearing, and regulatory fees still apply for all opening and closing equity options trades. All futures options and the following index products are excluded from this offer: SPX, RUT, VIX, OEX, XEO, DJX, XSP, CBTX, and MBTX.

$4,000* BONUS? SWEET.

Earn up to $4,000 bonus when you open and fund an account.

You Can Count On Us.

Because Traders Trust Us.

*Data as of 06/12/2025. Source: Trustpilot

tastytrade, Inc. (“tastytrade”) does not provide investment, tax, or legal advice. tastytrade’s website and brokerage services are not intended for persons of any jurisdiction where tastytrade is not authorized to do business or where such products and other services offered by the tastytrade would be contrary to the securities regulations, futures regulations or other local laws and regulations of that jurisdiction. Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC). All customer futures accounts’ positions and cash balances are segregated by Apex Clearing Corporation. Futures and futures options trading is speculative and is not suitable for all investors. Please read the Futures & Exchange-Traded Options Risk Disclosure Statement prior to trading futures products.

tastytrade, Inc. was formerly known as tastyworks, Inc.

©2017-2025 tastytrade, Inc.